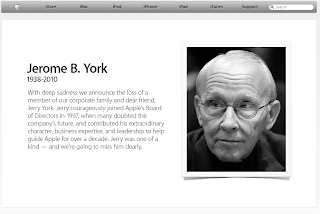

Apple Director Jerome B. York Passes Away

Jerome B. York, commonly known as Jerry York (1938 – March 18, 2010), was an American businessman, and the Chairman, President and CEO of Harwinton Capital. He was the former CFO of IBM and Chrysler. He was also CEO of Micro Warehouse and joined the board of directors of Apple Computer in 1997.

He was a chief aide to Kirk Kerkorian and his Tracinda investment company. Most recently, Kerkorian helped elect York to the board of directors of General Motors, from which he had previously resigned.

He was a chief aide to Kirk Kerkorian and his Tracinda investment company. Most recently, Kerkorian helped elect York to the board of directors of General Motors, from which he had previously resigned.

DETROIT — Jerome B. York, the financial expert who warned General Motors of a looming financial disaster and aided the billionaire investor, Kirk Kerkorian, in efforts to drive up the price of Chrysler stock, died on Thursday. He was 71.

Enlarge This Image Craig Ruttle/Bloomberg NewsJerome B. York warned General Motors of a looming financial disaster and aided the billionaire investor, Kirk Kerkorian, in efforts to drive up the price of Chrysler stock.

RelatedKerkorian Aide Tells G.M. to Be More Like Nissan (Jan. 11, 2006)G.M. Adds Blunt Critic To Board (Feb. 7, 2006)G.M. Is Pressed to Form Alliance With Two Rivals (July 1, 2006)Dissident Quits Board at G.M. (Oct. 7, 2006)Mr. York’s death was announced by Apple, where he had served as a director since 1997.

Bloomberg News reported on Wednesday that Mr. York had suffered a cerebral hemorrhage on Tuesday night at his home in Rochester, Mich. He was taken to the Pontiac Osteopathic Hospital in Pontiac, Mich., where he died.

Mr. York was the chief financial officer at International Business Machines from 1993 to 1995 and spent 14 years at Chrysler as well as serving on a number of corporate boards.

“Jerry joined Apple’s Board in 1997 when most doubted the company’s future,” said Steven P. Jobs, the company’s chief executive. “He has been a pillar of financial and business expertise and insight on our board for over a dozen years.”

Mr. York was frequently mentioned as a candidate to lead one of Detroit’s automobile companies. But his association with Mr. Kerkorian defined his legacy in Detroit, both at G.M. in this past decade and at Chrysler in the 1990s.

In January 2006, when Mr. Kerkorian was the largest investor in G.M., Mr. York spoke in Detroit of the need for the company, which lost $8.6 billion in 2005, to take radical action to address its financial problems. “The time has come to go into crisis mode and act accordingly,” Mr. York said.

He questioned why G.M. needed to keep selling Saturn, Saab and Hummer models, and suggested that the company halve its dividend, cut pay for top executives and emulate the turnaround plans carried out by Carlos Ghosn, the chief executive at Nissan of Japan and Renault of France.

A month later, Mr. York was named to the G.M. board, and in June 2006, Mr. Kerkorian wrote to Rick Wagoner, G.M.’s chief executive at the time, and Mr. Ghosn suggesting that the pair consider forming an alliance.

Although the two companies discussed the idea, the negotiations broke down over G.M.’s insistence that Renault and Nissan pay a $10 billion premium to G.M., which considered its reputation greater than that of the foreign carmakers.

Mr. York left the G.M. board soon afterward, deeply critical of the company’s reluctance to move more quickly. In a letter to G.M., Mr. York said he had not found “an environment in the boardroom that is very receptive to probing much beyond” data provided by management.

In a statement Thursday, Mr. Kerkorian said of Mr. York, “He was a unique individual with boundless courage, charisma and intellect, and a deep appreciation of the automotive industry.”

Jerome Bailey York was born on June 22, 1938, in Memphis. He graduated from the United States Military Academy at West Point, N.Y., and earned a master’s degree from the Massachusetts Institute of Technology and an M.B.A. from the University of Michigan.

A decade before urging G.M. to make changes, Mr. York served as Mr. Kerkorian’s point man in efforts to increase shareholder benefits at Chrysler. Mr. Kerkorian was also the largest shareholder there until the company merged with Daimler-Benz of Germany in 1998.

Mr. York joined Mr. Kerkorian’s Tracinda Corporation in 1995, a few months after Mr. Kerkorian made an unsuccessful bid to buy Chrysler in tandem with Lee Iacocca, the company’s former chief executive. Mr. York’s arrival was seen as an effort by Mr. Kerkorian to demonstrate his seriousness about yielding more benefits for shareholders at Chrysler, which Mr. Kerkorian felt had not paid high enough dividends.

Mr. York came to Tracinda from I.B.M., which he joined in 1993 as chief financial officer, part of the management team assembled by Louis V. Gerstner in his turnaround effort there.

At I.B.M., Mr. York assigned hundreds of managers to cost-cutting task forces, finding ways to save an estimated $2 billion. He was so well regarded on Wall Street that when his departure for Tracinda was announced, I.B.M. shares fell 2 percent as other computer company stocks rallied.

Before that, Mr. York was a finance executive at Chrysler in the 1980s, working with Mr. Iacocca in an effort to transform the company after it received federal loan guarantees from Congress.

One rare miss for Mr. York came with Micro Warehouse, a direct marketer of computers. Mr. York and a group of investors paid $275 million for the company, where he was chief executive from 2000 to 2003. But when the technology bubble burst, Micro Warehouse was sold to a competitor for just $22 million and filed for bankruptcy shortly thereafter.

Mr. York is survived by his wife, Eilene M. York; four children; and six grandchildren.

In early 2009, Mr. York predicted in an interview with Reuters that G.M. might be forced by the federal government to go through a “cram-down, quickie bankruptcy” in order to survive.

“There are no great choices here,” he said. “There are only bad choices. The question is what is the least bad choice.”

G.M. filed for bankruptcy protection in June 2009, and emerged a month later, assisted by $50 billion in federal aid. As part of its restructuring, it sold Hummer and Saab and closed Saturn. It cut its dividend and its executive salaries while trying to speed its decision-making — all things Mr. York had suggested years earlier.

Enlarge This Image Craig Ruttle/Bloomberg NewsJerome B. York warned General Motors of a looming financial disaster and aided the billionaire investor, Kirk Kerkorian, in efforts to drive up the price of Chrysler stock.

RelatedKerkorian Aide Tells G.M. to Be More Like Nissan (Jan. 11, 2006)G.M. Adds Blunt Critic To Board (Feb. 7, 2006)G.M. Is Pressed to Form Alliance With Two Rivals (July 1, 2006)Dissident Quits Board at G.M. (Oct. 7, 2006)Mr. York’s death was announced by Apple, where he had served as a director since 1997.

Bloomberg News reported on Wednesday that Mr. York had suffered a cerebral hemorrhage on Tuesday night at his home in Rochester, Mich. He was taken to the Pontiac Osteopathic Hospital in Pontiac, Mich., where he died.

Mr. York was the chief financial officer at International Business Machines from 1993 to 1995 and spent 14 years at Chrysler as well as serving on a number of corporate boards.

“Jerry joined Apple’s Board in 1997 when most doubted the company’s future,” said Steven P. Jobs, the company’s chief executive. “He has been a pillar of financial and business expertise and insight on our board for over a dozen years.”

Mr. York was frequently mentioned as a candidate to lead one of Detroit’s automobile companies. But his association with Mr. Kerkorian defined his legacy in Detroit, both at G.M. in this past decade and at Chrysler in the 1990s.

In January 2006, when Mr. Kerkorian was the largest investor in G.M., Mr. York spoke in Detroit of the need for the company, which lost $8.6 billion in 2005, to take radical action to address its financial problems. “The time has come to go into crisis mode and act accordingly,” Mr. York said.

He questioned why G.M. needed to keep selling Saturn, Saab and Hummer models, and suggested that the company halve its dividend, cut pay for top executives and emulate the turnaround plans carried out by Carlos Ghosn, the chief executive at Nissan of Japan and Renault of France.

A month later, Mr. York was named to the G.M. board, and in June 2006, Mr. Kerkorian wrote to Rick Wagoner, G.M.’s chief executive at the time, and Mr. Ghosn suggesting that the pair consider forming an alliance.

Although the two companies discussed the idea, the negotiations broke down over G.M.’s insistence that Renault and Nissan pay a $10 billion premium to G.M., which considered its reputation greater than that of the foreign carmakers.

Mr. York left the G.M. board soon afterward, deeply critical of the company’s reluctance to move more quickly. In a letter to G.M., Mr. York said he had not found “an environment in the boardroom that is very receptive to probing much beyond” data provided by management.

In a statement Thursday, Mr. Kerkorian said of Mr. York, “He was a unique individual with boundless courage, charisma and intellect, and a deep appreciation of the automotive industry.”

Jerome Bailey York was born on June 22, 1938, in Memphis. He graduated from the United States Military Academy at West Point, N.Y., and earned a master’s degree from the Massachusetts Institute of Technology and an M.B.A. from the University of Michigan.

A decade before urging G.M. to make changes, Mr. York served as Mr. Kerkorian’s point man in efforts to increase shareholder benefits at Chrysler. Mr. Kerkorian was also the largest shareholder there until the company merged with Daimler-Benz of Germany in 1998.

Mr. York joined Mr. Kerkorian’s Tracinda Corporation in 1995, a few months after Mr. Kerkorian made an unsuccessful bid to buy Chrysler in tandem with Lee Iacocca, the company’s former chief executive. Mr. York’s arrival was seen as an effort by Mr. Kerkorian to demonstrate his seriousness about yielding more benefits for shareholders at Chrysler, which Mr. Kerkorian felt had not paid high enough dividends.

Mr. York came to Tracinda from I.B.M., which he joined in 1993 as chief financial officer, part of the management team assembled by Louis V. Gerstner in his turnaround effort there.

At I.B.M., Mr. York assigned hundreds of managers to cost-cutting task forces, finding ways to save an estimated $2 billion. He was so well regarded on Wall Street that when his departure for Tracinda was announced, I.B.M. shares fell 2 percent as other computer company stocks rallied.

Before that, Mr. York was a finance executive at Chrysler in the 1980s, working with Mr. Iacocca in an effort to transform the company after it received federal loan guarantees from Congress.

One rare miss for Mr. York came with Micro Warehouse, a direct marketer of computers. Mr. York and a group of investors paid $275 million for the company, where he was chief executive from 2000 to 2003. But when the technology bubble burst, Micro Warehouse was sold to a competitor for just $22 million and filed for bankruptcy shortly thereafter.

Mr. York is survived by his wife, Eilene M. York; four children; and six grandchildren.

In early 2009, Mr. York predicted in an interview with Reuters that G.M. might be forced by the federal government to go through a “cram-down, quickie bankruptcy” in order to survive.

“There are no great choices here,” he said. “There are only bad choices. The question is what is the least bad choice.”

G.M. filed for bankruptcy protection in June 2009, and emerged a month later, assisted by $50 billion in federal aid. As part of its restructuring, it sold Hummer and Saab and closed Saturn. It cut its dividend and its executive salaries while trying to speed its decision-making — all things Mr. York had suggested years earlier.

from: www.nytimes.com

Comments

Post a Comment